-

-

Myths About the 2024 Housing Market...

Read more

-

-

Unlock the secrets to selling your home successfully in Southern California's competitive real estate market with our expert tips. Learn how to highlight your property's best features, attract motivated buyers, and achieve top dollar for your home. From enhancing curb appeal to strategic pricing and effective marketing, my proven strategies will help your listing stand out in the crowded landscape. Partner with me to maximize your home's potential and navigate the selling process w/c...

Read more

-

-

As we celebrate International Women's Day, let us reaffirm our commitment to advancing women's equality and empowerment. Let us recognize the achievements of women past and present, while also acknowledging the work that lies ahead. Together, we can create a world where every woman and girl can realize her full potential, free from discrimination and inequality....

Read more

-

-

As we celebrate International Women's Day, let us reaffirm our commitment to advancing women's equality and empowerment. Let us recognize the achievements of women past and present, while also acknowledging the work that lies ahead. Together, we can create a world where every woman and girl can realize her full potential, free from discrimination and inequality....

Read more

-

-

Merry Christmas, and Thank you. ...

Read more

-

-

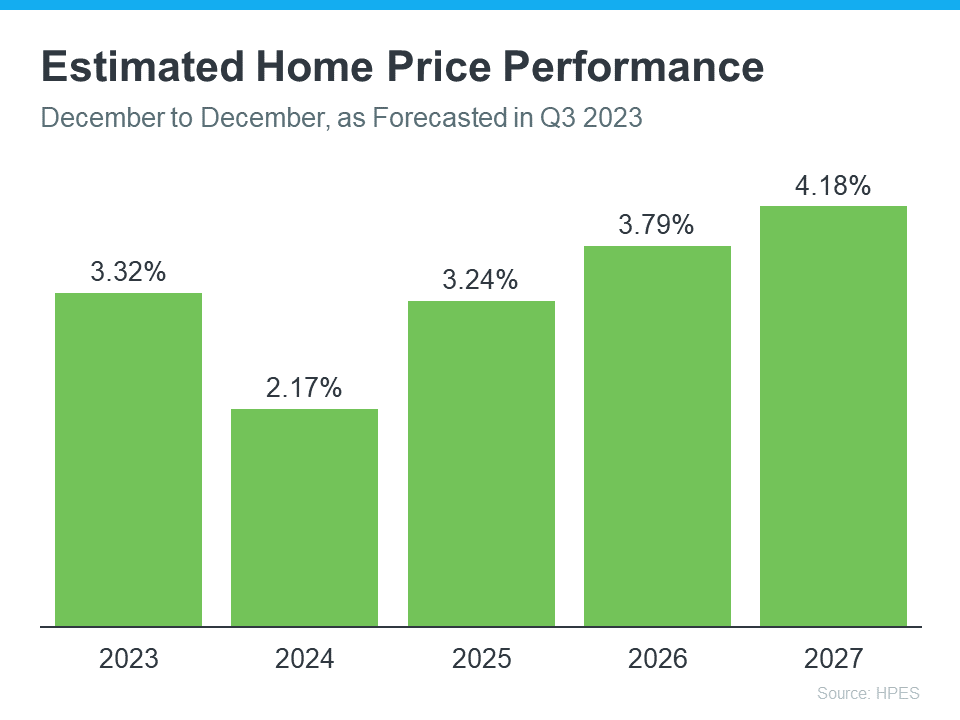

If you’re someone who’s worried home prices are going to fall, rest assured a lot of experts say it’s just the opposite – nationally, home prices will continue to climb not just next year, but for years to come...

Read more

-

-

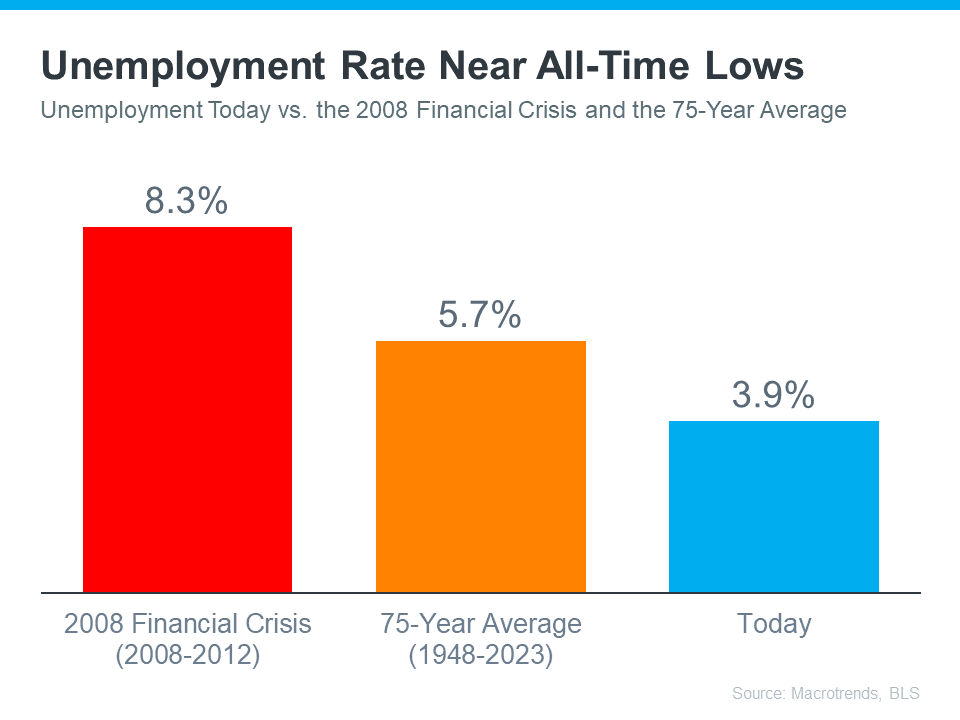

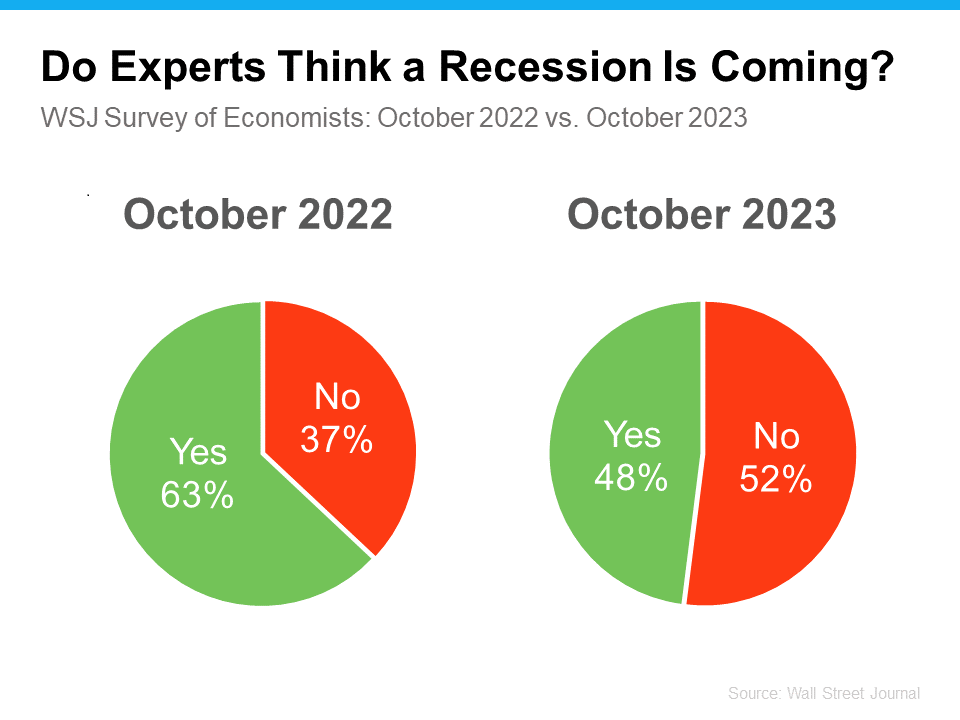

Why the Economy Won’t Tank the Housing Market...

Read more

-

-

Are the Top 3 Housing Market Questions on Your Mind?...

Read more

-

-

How does home staging help increase the value of a home? Read this guide for 5 simple tips on staging your home to attract more buyers....

Read more